Renewed Optimism Over Jobs Data and China Trade Talks Fuels US Stock Rally

U.S. stock markets experienced a significant surge as optimism surrounding job data and ongoing trade talks between the U.S. and China took center stage. On June 7, 2025, the tech-heavy Nasdaq Composite rose by 1.2%, closing at 19,529.95, while the S&P 500 climbed 1.03% to finish at 6,000.36. The Dow Jones Industrial Average also saw a healthy increase of 1.05%, ending the day at 42,762.87.

A trader works on the floor of the New York Stock Exchange (NYSE) at the opening bell in New York City, on June 2, 2025. (AFP Photo)

Labor Market Data Signals Resilience in the US Economy

The rally in stock prices was primarily driven by a favorable jobs report from the U.S. Labor Department. Non-farm payrolls showed an increase of 139,000 jobs in May, surpassing market expectations set at 126,000. This data suggests a strong labor market, mitigating concerns about a broader economic slowdown. Notably, April’s job growth was revised down from 177,000 to 147,000.

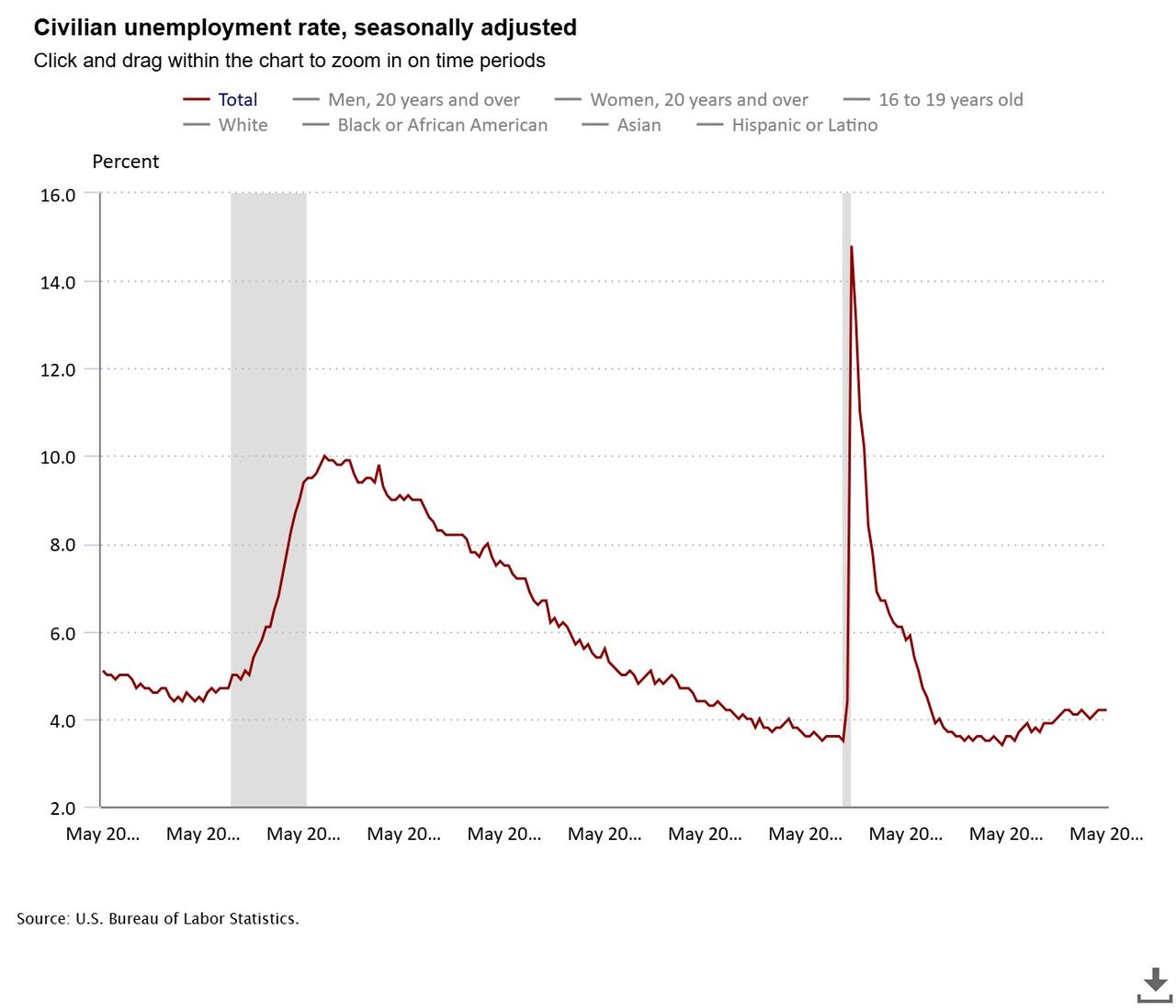

Employment gains were predominantly in sectors like healthcare, leisure and hospitality, and social assistance, while the federal government saw further job losses. The unemployment rate held steady at 4.2%, in line with analyst forecasts. However, the labor force participation rate edged down by 0.2 percentage points to 62.4%. On a brighter note, average hourly earnings saw a 0.4% increase from the previous month, marking a notable 3.9% year-on-year rise.

Line graph illustrates the seasonally adjusted US unemployment rate over five years, as of June 7, 2025. (Chart via bls.gov)

Market Momentum Fueled by Trump’s Remarks on Trade Talks

Adding to the market’s upward trajectory were optimistic signals from recent trade negotiations between the U.S. and China. On Friday, President Trump announced a forthcoming meeting in London involving U.S. officials and their Chinese counterparts to discuss key trade issues. This includes Treasury Secretary Scott Bessent, Commerce Secretary Howard Lutnick, and U.S. Trade Representative Jamieson Greer.

Trump’s positive outlook followed a phone call with Chinese President Xi Jinping, during which he described the conversation as having reached a "very positive conclusion for both countries." The anticipation surrounding this impending meeting is palpable, especially after a recent May 12 agreement that aimed to suspend most tariffs for 90 days. However, tensions resurfaced as both nations accused each other of failing to uphold the terms of the previous accord.

U.S. Treasury Secretary Scott Bessent and other officials before meeting to discuss trade relations with China in Geneva, on May 11, 2025. (AFP Photo)

Tesla Rebounds After Sharp Losses

Tesla shares were also in the spotlight amid the recent market fluctuations. After experiencing a steep decline of around 14% on Thursday due to a public disagreement between CEO Elon Musk and President Trump, Tesla’s stock rebounded by 3.67% by week’s end. This partial recovery indicated a revival of investor confidence, despite the previous drop that erased nearly $150 billion in market value.

The conflict stemmed from Trump announcing the suspension of government contracts linked to Musk’s firms, particularly involving SpaceX’s collaboration with NASA, following Musk’s criticisms of a tax bill proposed by the Republican president.

In summary, the positive labor market data coupled with renewed hope for productive trade talks between the U.S. and China has invigorated U.S. stock markets. Investors remain cautiously optimistic as the economic landscape evolves, with eyes squarely fixed on upcoming negotiations and Federal economic indicators.