Understanding the Impact of Tariffs on AI Hardware: A Competitive Analysis

The State of AI Hardware and Its Importance

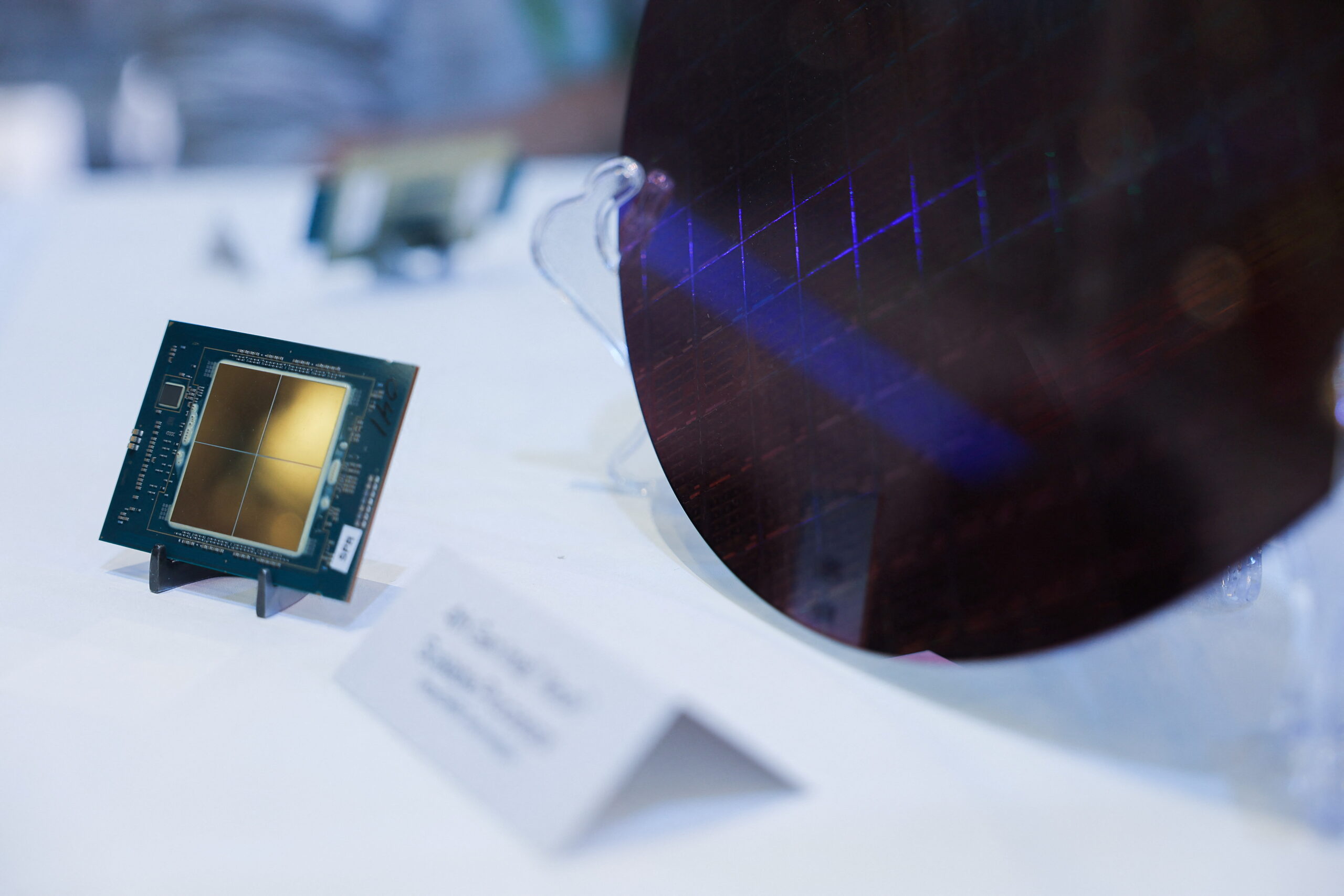

In the fast-paced world of artificial intelligence (AI), the hardware that supports these technologies plays a pivotal role. The United States stands at a crossroads, tasked with maximizing its competitiveness in AI development while navigating complex trade dynamics. As AI becomes increasingly integrated into various sectors, the demand for essential hardware like semiconductors—particularly graphics processing units (GPUs) and central processing units (CPUs)—has surged. However, the ongoing discourse around tariffs raises critical questions about the potential consequences of such economic measures.

The Tariff Dilemma

Under the Trump administration, an investigation was launched into semiconductor imports under Section 232 of the Trade Expansion Act, primarily focusing on national security implications. This inquiry laid the groundwork for potential tariffs aimed at semiconductor imports, which could have severe ramifications for U.S. tech firms. While the intention behind imposing tariffs may be to strengthen domestic industries, doing so indiscriminately across all imports could inadvertently raise prices for U.S. AI companies, stifle innovation, and even disadvantage friendly trade partners like Taiwan and Mexico.

The High Costs of Tariffs

The imposition of tariffs on crucial semiconductor imports could inflate hardware costs significantly. Basic AI components, from GPUs to printed circuit assemblies (PCAs), act as key cost drivers in the production and training of AI models. For instance, the cost of PCA imports has more than quintupled since 2021, largely due to increased demand driven by AI technologies. Thus, imposing tariffs could lead to a slowdown in the U.S. AI buildout, hampering the country’s progress in this strategic sector.

Dual-Use Technology and Key Partnerships

The U.S. tech sector relies heavily on dual-use technologies—those designed for both civilian and military applications. Taiwan and Mexico are significant contributors to this landscape. Taiwan, home to the world’s leading semiconductor manufacturer, has made substantial investments in U.S. tech, while Mexico is the largest supplier of essential AI components by value. Tariffs on these imports would not only strain partnerships but also limit the access that U.S. firms have to a global marketplace which is crucial for maintaining a competitive edge against China.

The Stakes in the Tech Race

As the U.S. and its allies face fierce competition from China in the AI sector, it is vital that they do not allow China to dictate the rules of engagement. Restricting imports through tariffs could inadvertently benefit Chinese firms. Instead of hindering China, U.S. tariffs might push other countries, particularly in Southeast Asia, to consolidate their alliances with Beijing, thereby further complicating the geopolitical landscape.

The Economic Dynamics of AI Hardware

Research has shown that a significant portion of the costs incurred in AI training comes from hardware acquisition. Researchers attribute about half of the expenses related to training machine learning models to the prices of AI accelerator chips and other server components. As hyperscalers invest heavily—$200 billion in 2024 alone—rising costs driven by tariffs could deter new entrants to the market and reduce overall innovation.

Potential Consequences of Tariffs on Global Trade

The ramifications of implementing tariffs extend beyond the U.S. tech sector. Evidence suggests that Chinese firms could benefit from technology leakage as countries like Malaysia enhance trading and investment partnerships with China. In the face of increased tariffs, some nations may find it more advantageous to collaborate with Beijing, further strengthening China’s position in the global tech hierarchy.

Navigating the Complexity of Export Controls

Given the complexities associated with tariffs, it’s essential for policymakers to consider alternative measures for ensuring the U.S. tech sector remains competitive. Recent efforts, such as bipartisan export controls targeting high-end semiconductor technology, have been designed to limit China’s access to crucial resources without imposing tariffs. However, these controls must be carefully calibrated to avoid unintended consequences.

Strengthening Domestic Capabilities

To effectively compete against China, the U.S. must bolster its domestic semiconductor capabilities. Legislative measures like the CHIPS and Science Act aim to incentivize manufacturing and technological expertise in the semiconductor sector, representing a proactive approach beyond merely imposing tariffs. While tariffs may seem like a straightforward solution, they do not sufficiently promote investment or growth within the industry.

Looking Ahead

As the landscape of artificial intelligence continues to evolve, the U.S. finds itself in a race not only for technological supremacy but also for setting the standards and regulatory frameworks surrounding this transformative sector. The stakes are high, especially as the pursuit of artificial general intelligence (AGI) intensifies. Ensuring that the U.S. remains at the forefront of these developments requires a nuanced understanding of both domestic capabilities and international trade dynamics.

By fostering key partnerships and carefully delineating trade policies, the U.S. can proactively secure a position of advantage in an increasingly competitive global environment. The journey ahead is riddled with challenges, but the potential rewards of being a leader in AI are substantial, offering significant economic and strategic benefits.