Insights from the July Bain/Dynata Consumer Health Index

Business operators and members of the press can request a full copy of this month’s report here.

Robust Recovery for Upper-Income Earners

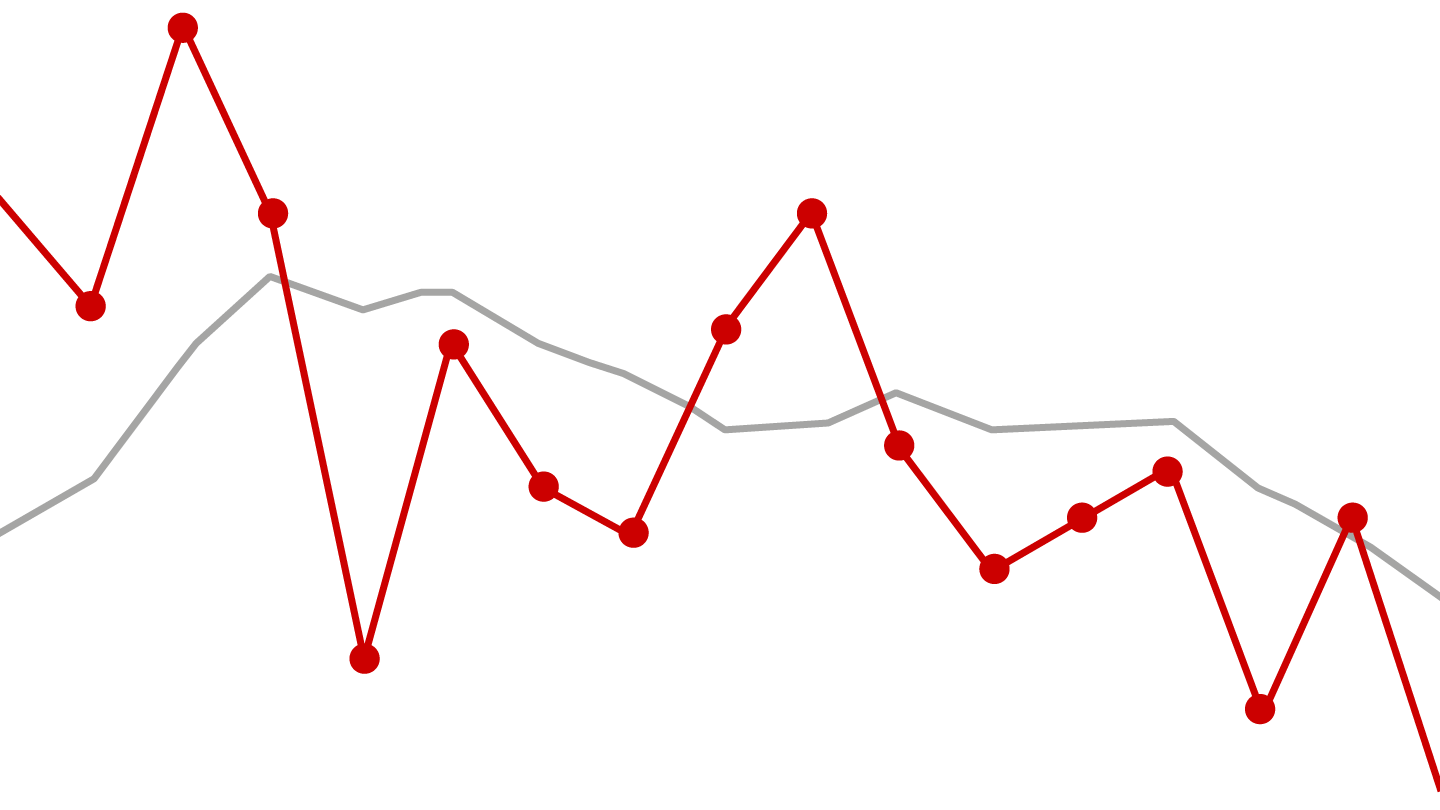

The latest Bain/Dynata Consumer Health Indexes (CHI) highlights a remarkable turnaround in consumer sentiment, particularly among upper-income earners. In July, the headline measure of US consumer outlook surged sharply, reflecting growing optimism amidst rising equity markets. Upper-income earners, whose wealth is predominantly tied to their investment portfolios, have seen their outlook rebound. The measure for this group increased by a significant 6 points in just four weeks, escalating 16.5 points over the past two months. This places their outlook at levels that exceed those recorded before the discussions surrounding tariffs in April.

Spending Intent on the Rise

With this renewed optimism, the spending intention among upper-income earners has surged by 2.4 points in July, bringing it to 112.4—well above the average of the previous year. A reading over 100 indicates a positive sentiment, and these figures suggest a buoyancy not observed since November 2023, when spending began to wane post-COVID. This optimism, largely driven by equities reaching all-time highs, indicates a confidence that could potentially invigorate consumer spending.

The Middle-Income Perspective

In stark contrast, middle-income earners report a decidedly less rosy outlook. Their sentiment gauge has stalled since March, hovering just above a neutral score of 100. The intent to spend for this group has dipped into negative territory, falling to 97.4—down 3 points over two months. This decline is largely attributed to stagnation in housing markets across the nation, which seems to dampen their overall spending intentions.

Lower-Income Concerns Persist

Lower-income earners continue to face a challenging landscape, with their outlook remaining wobbly. Following a sharp dip last month, the CHI score held steady in July at 96.6, reflecting ongoing concerns regarding job stability and overall labor market health. The negative sentiment among lower-income consumers underscores a broader narrative of uncertainty in the job market, contributing to their restrained spending behaviors.

Implications for Overall Consumer Spending

The disparity in outlook among the different income groups paints a complex picture for consumer spending trends. While upper-income earners represent a significant portion of discretionary spending, their current euphoria is not guaranteed to endure. The sustainability of their positive outlook hinges on the continued performance of the equity markets and the financial well-being of middle- and lower-income households. Should these lower-income groups experience a further decline in sentiment, it could negatively impact company earnings and, consequently, the broader market.

The Role of Consumer Health Indexes

The Bain and Dynata Consumer Health Indexes, established in 2017, aim to provide crucial insights for business leaders as they navigate market dynamics. By asking straightforward questions regarding personal spending, saving, and debt plans, these indexes bypass complex macroeconomic interpretations, delivering clear insights into consumer behaviors. Clients utilize the CHI as a unique metric compared to traditional confidence indicators, equipping them for informed decision-making.

To request a full copy of our most recent report, click here.

Discover More

Bain’s Macro Strategy Platform is a subscription service designed to offer clients tailored macro-surveillance solutions, aiding them in making strategic business decisions.